Exchange rate

Exchange rate is the rate at which one country’s currency can be exchanged for another country’s currency.

Floating Exchange Rate

Floating exchange rate system means that the exchange rate is allowed to fluctuate according to the market forces without the intervention of the Central bank or the government.

Appreciation and Depreciation

The exchange rate for any currency usually fluctuates. When the value of the currency goes up as compared to other currency it is known as appreciation. When the value of currency falls as compared to other currency it is known as depreciation.

Usually the exchange rates are determined by the demand and supply of that currency in the international market.

Demand for any country’s currency on the foreign exchange market is determined by demand for that country’s exports of goods and services and by changes in foreign investment in that country. This is because when foreigners buy another country’s exports of goods or services they must pay for these in the currency of the exporting country.

In the same way Supply of any country’s currency on the foreign exchange market is determined by that country’s imports of goods and services and by its investment in other countries.

Thus when the demand for a currency rises its price goes up and it becomes costlier.

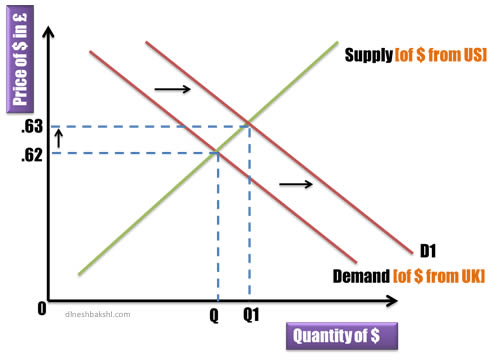

As we can see in the diagram as the demand for $ from UK increases it price in terms of £ goes up from .62 to .63.

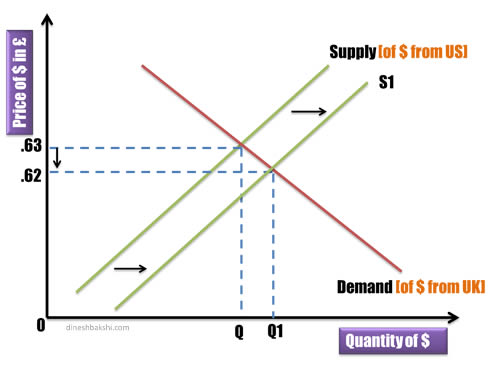

Similarly, we can see that the supply of dollar in the market increases which forces its price down from .63 to .62.

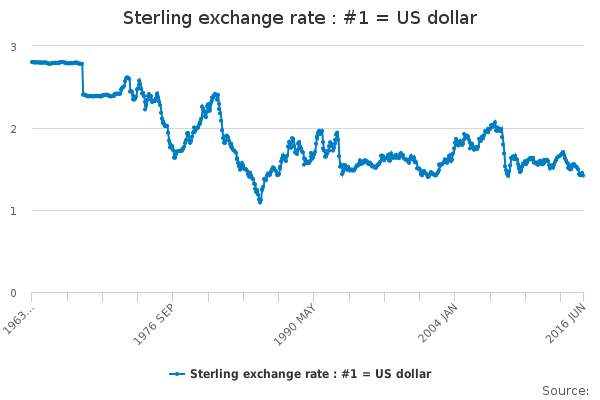

Sterling exchange rate to US dollar - 10 Years data

Source: https://www.ons.gov.uk

What causes the fluctuation in currency value?

Changes in the imports and exports of the country: An increase in exports of a country will lead to an increase in demand for the currency and thus the value rises.

Changes in Interest rate: Higher interest rate will attract more foreign investors to invest in the country and thus the demand for currency will rise, resulting in appreciation in value of the currency.

Changes in Inflation rate: Higher inflation rate will make the country uncompetitive in the international market. The exports will fall resulting in decreased demand for the currency and hence lower value.

Rise in domestic income relative to incomes abroad: currency depreciates.

Investment opportunities: if bright lead to appreciation.

Speculative sentiments: Individuals and institutions invest in currency markets with the sole intention to get short term gains. This is quiet like investing in stock exchange. Whenever a currency is going strong, people will invest more in an expectation to gain from it. This fuels the demand for that particular currency and it appreciates further.

Global trading patterns: if strong global presence in trade then the currency appreciates.

Changes in relative inflation rates: high inflation rate leads to exports becoming less competitive in international market

Effect of exchange rate changes

Exchange rate fluctuation effects country’s inflation rate, employment, economic growth and current account balance.

Lets see how…

Scenario 1- Currency depreciates

A depreciation in exchange rate should lead to a rise in demand for exports and a fall in demand for imports – the balance of payments should ‘improve’,

Exports will improve, this will lead to more output, more employment will be created thus economic growth will be achieved. However, exports is a component of AD, an increase in exports will lead to the shift of AD to the right and might also lead to inflation. The economy might also suffer from ‘imported inflation’ as imports are now expensive due to depreciation of your currency.

Scenario 2 – Currency appreciates

An appreciation of the exchange rate should lead to a fall in demand for exports and a rise in demand for imports – the balance of payments should get ‘worse’.

When exports fall, real output will fall which leads to unemployment. Economic growth is compromised and the economy may suffer from ‘deflationary gap’.

However, The volumes and the actual amount of income and expenditure will depend on the relative price elasticity of demand for imports and exports. Refer to Marshall-Lener curve.

Watch a Video Series

Consequences of overvalued and undervalued currencies

Overvalued Currency

Advantages

- Downward pressure on inflation i.e. imported goods will be cheaper

- More imports can be bought

- High value of currency forces domestic producers to improve their efficiency to be more competitive in the international market.

Disadvantages

- Overvalued currency will make exports uncompetitive in the international market which will hurt the export industries

- Imports are relatively cheaper to buy due to overvalued currency. Consumers will go in for more imports which will damage to domestic industries

Undervalued currency

Advantages

- If currency is undervalued, the exports will be cheaper and they will grow leading to greater employment in export industries

- Undervalued currency will make imports expensive for consumers, they will divert to domestic goods and thus employment in domestic industries will increase.

Disadvantages

As discussed earlier undervalued currency makes imports expensive which also leads to Imported inflation i.e. all the products using imported components/raw material will become expensive thus effecting the general price level.

Government Intervention in the exchange rate

Fixed Exchange Rate

A fixed exchange rate system refers to the case where the exchange rate is set and maintained at same level by the government irrespective of the market forces.

Revaluation and Devaluation

It refers to official changes in the price of a currency in a fixed exchange rate system.

- Devaluation is when the price of the currency is officially decreased in a fixed exchange rate system.

- Revaluation is the official increase in the price of the currency within a fixed exchange rate system.

Managed Exchange Rate

A managed exchange rate occurs when there is official intervention by a government or an agency such as the Central Bank to determination the value of a country’s exchange rate. Through such official interventions it is possible to manage both fixed and floating exchange rates.

For example,

The Fedral Bank may decide to enter the foreign exchange market as either a buyer or seller to stabilise any short-term fluctuation in the value US$. To limit a fall in the value of US$ (depreciation) the Fed will buy US$, and to prevent a rise in the value of US$, the central bank will sell US$ in the market.

Such intervention by the central bank is known as a “dirty float”, or more correctly a “managed float”.

Other Government actions and their effect

Expansionary monetary policy (↑MS) causes an increase in GNP and a depreciation of the domestic currency in a floating exchange rate system in the short run.

Contractionary monetary policy (↓MS) causes a decrease in GNP and an appreciation of the domestic currency in a floating exchange rate system in the short run.

Expansionary fiscal policy (↑G, ↑TR, or ↓T) causes an increase in GNP and an appreciation of the domestic currency in a floating exchange rate system.

Contractionary fiscal policy (↓G, ↓TR, or ↑T) causes a decrease in GNP and a depreciation of the domestic currency in a floating exchange rate system.

In the long run, once inflation effects are included, expansionary monetary policy (↑MS) in a full employment economy causes no long-term change in GNP and a depreciation of the domestic currency in a floating exchange rate system. In the transition, the exchange rate overshoots its long-run target and GNP rises then falls.

A sterilized foreign exchange intervention will have no effect on GNP or the exchange rate in the AA-DD model, unless international investors adjust their expected future exchange rate in response.

A central bank can influence the exchange rate with direct Forex interventions (buying or selling domestic currency in exchange for foreign currency). To sell foreign currency and buy domestic currency, the central bank must have a stockpile of foreign currency reserves.

A central bank can also influence the exchange rate with indirect open market operations (buying or selling domestic treasury bonds). These transactions work through money supply changes and their effect on interest rates.

Purchases (sales) of foreign currency on the Forex will raise (lower) the domestic money supply and cause a secondary indirect effect upon the exchange rate.